Why the Economy Won’t Tank the Housing Market, Especially in Los Angeles and Beverly Hills

Why the Economy Won’t Tank the Housing Market, Especially in Los Angeles and Beverly Hills | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

In the context of the ever-changing economic landscape and its potential impact on the housing market, concerns about a recession are widespread. This is particularly true in high-stakes markets like Los Angeles and Beverly Hills, where the real estate sector plays a crucial role in the local economy. However, recent data provides a more optimistic outlook, especially for these prestigious areas.

The latest Economic Forecasting Survey from the Wall Street Journal (WSJ) indicates a shift in expectations, with less than half of economists now predicting a recession within the next year. This decline in recession probability – from 54% in July to 48% – is significant, particularly for markets like Los Angeles and Beverly Hills, where real estate investments are closely tied to economic conditions.

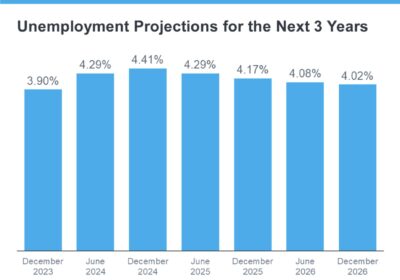

Regarding unemployment, which is often a precursor to housing market instability, the same WSJ survey projects that the rate will remain below the 75-year average. This is crucial for areas like Los Angeles and Beverly Hills, where the economy is diversified and robust, often resisting national unemployment trends. Even in the face of job losses, the unique dynamics of these markets – including their appeal to high-net-worth individuals and the constant demand for luxury properties – help buffer against the broader economic downturns.

Historical data from Macrotrends and the Bureau of Labor Statistics (BLS) reinforces this. While the average unemployment rate since 1948 is 5.7%, and it spiked to 8.3% during the 2008 financial crisis, current rates are significantly lower. This suggests that the feared wave of foreclosures impacting markets like Los Angeles and Beverly Hills is unlikely. These areas have historically shown resilience in real estate values, even during economic downturns.

In Los Angeles and Beverly Hills, the real estate market's stability is bolstered by several factors. These include the ongoing demand for luxury properties, a limited supply of such properties, and a continuous influx of both domestic and international buyers attracted to the lifestyle and status these areas offer.

Bottom Line for Los Angeles and Beverly Hills The current economic outlook, including the reduced likelihood of a recession and stable unemployment projections, is reassuring for the real estate markets in Los Angeles and Beverly Hills. These areas are likely to maintain their robustness, given their unique market dynamics and appeal. For those with questions about how the broader economic landscape might impact the real estate market in these prestigious areas, connecting with an experienced local agent is recommended for personalized insights and guidance.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value.