Why Rising Foreclosures and Bankruptcies Won’t Derail the Los Angeles & Beverly Hills Housing Market

Why Rising Foreclosures and Bankruptcies Won't Derail the Los Angeles & Beverly Hills Housing Market | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

If you're keeping an eye on real estate trends, especially in elite locales like Los Angeles and Beverly Hills, you may have encountered headlines indicating an uptick in foreclosures and bankruptcies. Given the exclusivity and high stakes of the housing market in these areas, such news can understandably lead to concerns.

Foreclosure Activity: More Nuanced Than Headlines in LA and Beverly Hills

It's true that foreclosure numbers have been increasing recently. However, this follows an unprecedentedly low foreclosure rate in 2020 and 2021 due to the forbearance program and other financial relief measures. These programs were especially beneficial in high-cost areas like Beverly Hills, where property values can be extremely volatile.

But, is the Los Angeles and Beverly Hills housing market on the brink of a downturn? The data suggests otherwise.

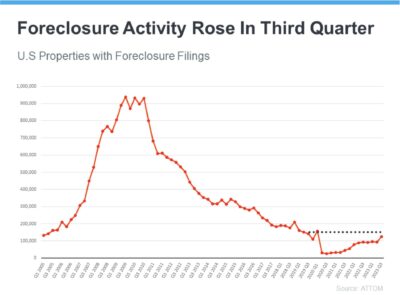

Here's a graph using research from ATTOM, a property data provider, that places this in historical context:

The graph paints a clear picture: Foreclosure rates in Los Angeles and Beverly Hills may be trending upwards to pre-pandemic levels, but they are nowhere near the highs seen during the 2008 housing crash. In fact, due to the robust appreciation in property values across these affluent neighborhoods, homeowners are sitting on a significant amount of equity. This equity cushion can be a lifeline, enabling homeowners to sell their properties and avoid foreclosure.

Bankruptcy Trends in LA: Less Alarming Than You Think

The slight increase in bankruptcy numbers is less dramatic than it appears at first glance, especially within the context of the Los Angeles and Beverly Hills real estate market.

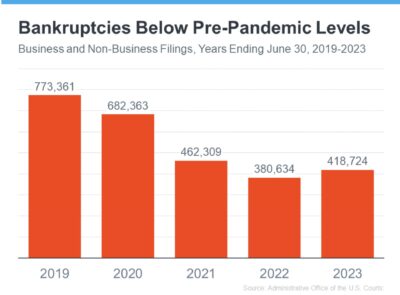

Here's another graph to put this in perspective:

While there has been a moderate uptick in bankruptcies since last year, the numbers are still significantly lower than what we saw pre-pandemic. Thanks to substantial government aid during the pandemic, businesses and homeowners in Los Angeles and Beverly Hills were more resilient to financial shocks.

Market Dynamics: LA & Beverly Hills Edition

It’s worth noting that the real estate landscape in Los Angeles and Beverly Hills is characterized by unique supply-demand dynamics. Limited land availability, strong international interest, and premium amenities make these areas less susceptible to market volatility seen in other regions. These factors often buffer the market against macroeconomic pressures to some extent.

Bottom Line: Read the Data, Not Just the Headlines

While the trends in foreclosures and bankruptcies are worth monitoring, they are not indicative of impending doom for the housing market, particularly in exclusive locations like Los Angeles and Beverly Hills. By understanding the nuances in the data, it becomes evident that these key indicators are not signaling the type of trouble that would lead to a real estate crisis.

So, whether you're eyeing a luxurious estate in Beverly Hills or a chic loft in downtown Los Angeles, rest assured that the market fundamentals remain strong. For anyone considering a property transaction in these areas, the key takeaway is to delve deeper into the data and consult experts to make informed decisions.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value.