Why Buying Beats Renting in Los Angeles and Beverly Hills Real Estate Markets

Why Buying Beats Renting in Los Angeles and Beverly Hills Real Estate Markets | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

In the heart of Los Angeles and the illustrious Beverly Hills, the debate between renting and buying is more relevant than ever, especially with the current real estate climate. Recent reports might suggest that renting could be more cost-effective in the short term when considering monthly payments alone. However, this perspective overlooks a critical financial benefit of homeownership: equity accumulation.

Analyzing the Cost Differences

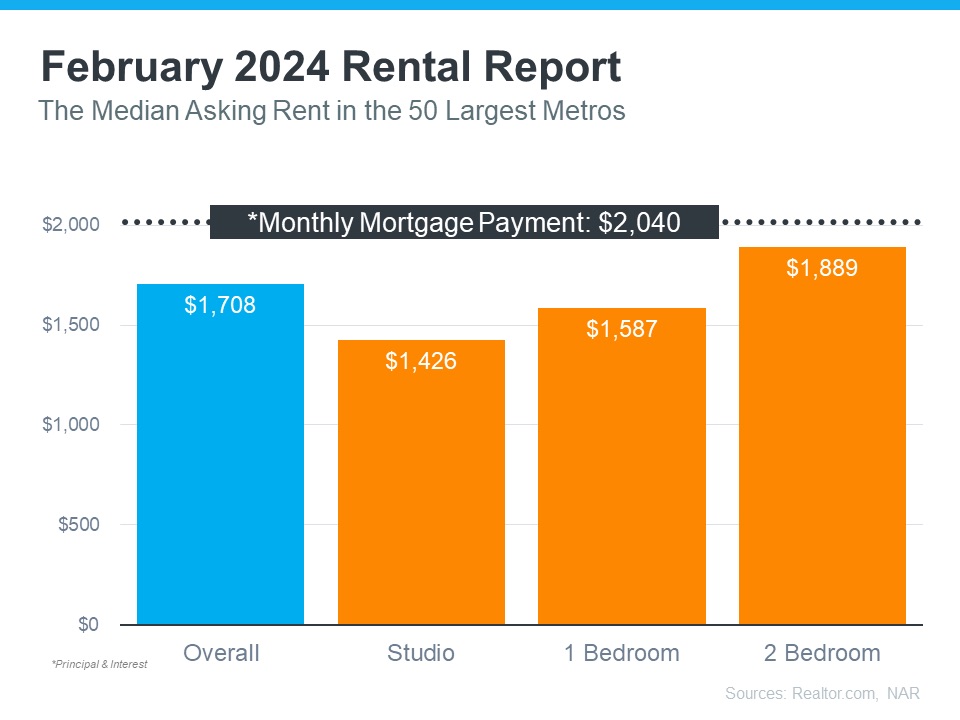

National data from Realtor.com and the National Association of Realtors (NAR) contrasts the median rental and mortgage payments across the U.S. While initially, renting may appear less expensive, particularly for smaller living spaces, the gap narrows significantly with larger properties. For instance, the median mortgage for a two-bedroom is approximately $2,040, compared to $1,889 for the same rental, a mere $151 difference monthly.

The Power of Home Equity in LA and Beverly Hills

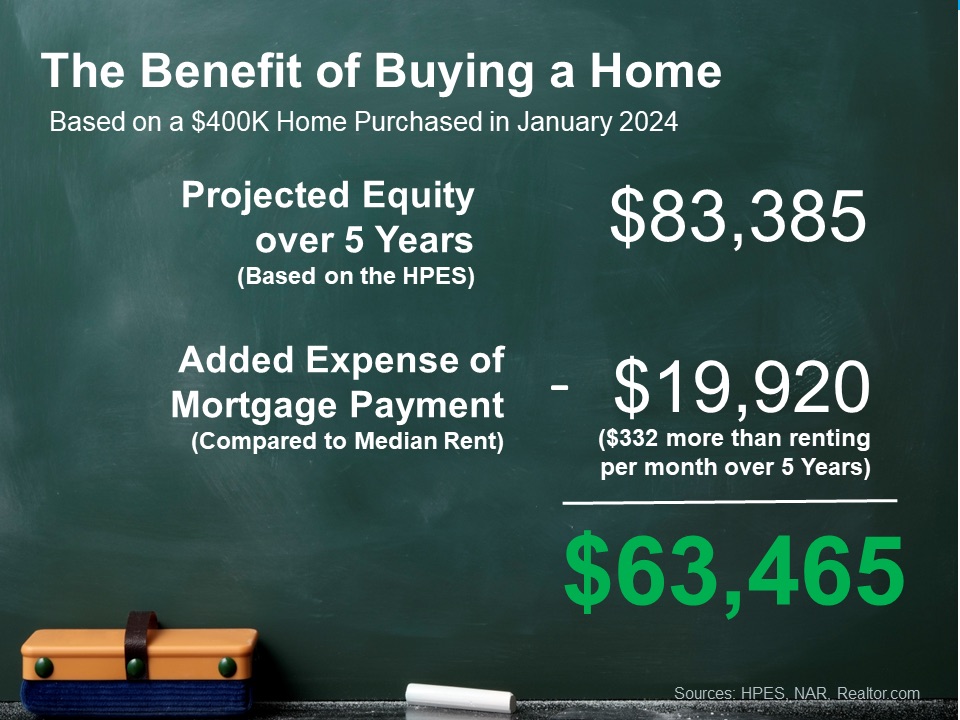

The true advantage of buying a home becomes apparent when considering equity. Rent payments primarily contribute to the landlord's pocket, leaving renters with little financial gain post-lease beyond the return of a deposit. In contrast, each mortgage payment not only secures your living space but also invests in your financial future through equity. This investment is enhanced as property values increase, a common trend in the upscale markets of Los Angeles and Beverly Hills.

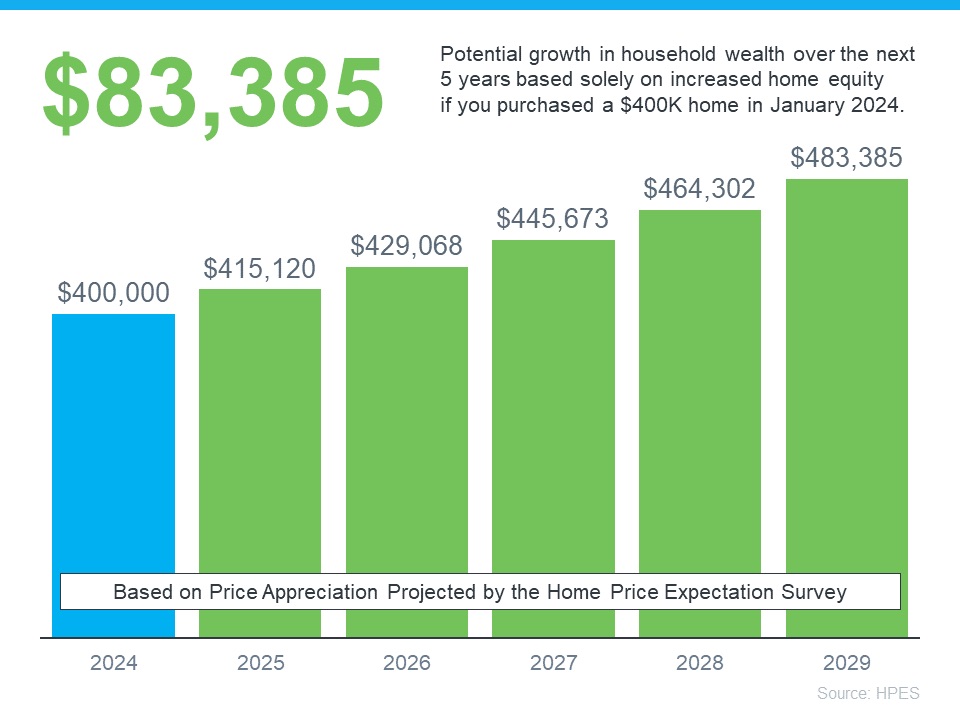

Experts, including over 100 economists and market strategists surveyed in the Home Price Expectations Survey (HPES) by Fannie Mae and Pulsenomics, predict a continuous rise in home values. For example, purchasing a $400,000 home could potentially lead to an increase in household wealth by more than $83,000 over five years due to property appreciation.

Long-term Benefits Over Short-term Savings

While renting may offer short-term savings on monthly payments, it lacks the long-term financial growth provided by homeownership through equity. This growth is particularly significant in high-value areas like Beverly Hills and Los Angeles, where property appreciation rates are formidable.

Conclusion: Making the Strategic Choice

The decision to buy or rent in Los Angeles and Beverly Hills should consider more than just immediate affordability. Prospective homeowners must evaluate their financial readiness and long-term goals. For those positioned to invest, the potential equity gains make purchasing a compelling option over renting.

If you're contemplating entering the real estate market in these iconic regions, understanding the nuances of equity and property value trends is crucial. For personalized advice and to explore your options in one of the world's most coveted real estate markets, connect with a local expert who can guide you through the complexities of buying versus renting in this dynamic landscape.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value