Why a Crash Isn’t on the Horizon: Los Angeles and Beverly Hills Real Estate

Why a Crash Isn't on the Horizon: Los Angeles and Beverly Hills Real Estate | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

Introduction: The memory of the 2008 housing crash still lingers in the minds of many, even for those who didn't own homes at the time. Concerns about a repeat performance may naturally arise when discussing the current state of the housing market. However, there is some good news – the housing market today is fundamentally different from what it was in 2008. One key factor setting it apart is the evident shortage of homes for sale, which stands in stark contrast to the oversupply that precipitated the previous crisis. To truly understand why a crash isn't looming on the horizon, let's delve into the specifics of today's housing inventory while focusing on the vibrant real estate scenes in Los Angeles and Beverly Hills, California.

Housing Supply Sources: To get a comprehensive view of the current housing inventory, it's essential to consider the three main sources of housing supply:

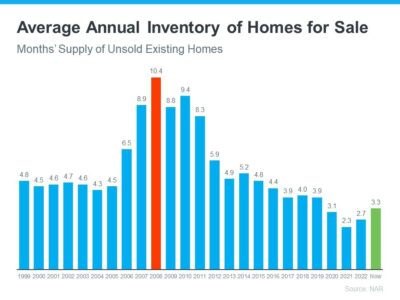

- Homeowners Deciding To Sell Their Houses: While the housing supply has seen modest growth compared to the previous year, it remains relatively low. In fact, the current months' supply of housing is below the norm. To illustrate this, we can compare the available inventory today to the situation in 2008. A quick glance at the graph below highlights the significant disparity between the two periods. The latest data (shown in green) reveals only about a third of the available inventory compared to 2008 (shown in red).

What does this mean for the market? Simply put, there are not enough homes available to trigger a significant drop in home values. To replicate the conditions of 2008, we would need a situation where a substantial number of homeowners are trying to sell their houses with very few buyers in sight, and that is not the case today, especially in the vibrant real estate markets of Los Angeles and Beverly Hills.

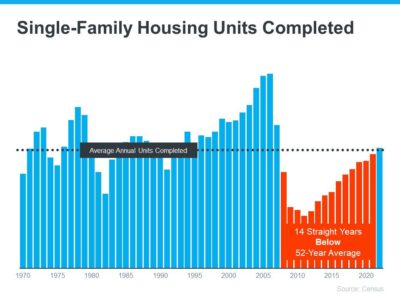

- Newly Built Homes: A topic that's often discussed in real estate circles is the current trend in newly built homes. This might lead some to question if homebuilders are overdoing it. A closer look at the graph below reveals the number of new houses built over the last 52 years.

- The notable 14-year period of underbuilding (shown in red) is a significant factor contributing to the current low housing inventory. Builders have not been constructing enough homes for several years, resulting in a substantial supply deficit. While the most recent blue bar on the graph indicates a rise in construction, it is important to note that this increase is on pace to reach the long-term average, and it will not suddenly create an oversupply. Builders are now more cautious about avoiding overbuilding, unlike during the housing bubble.

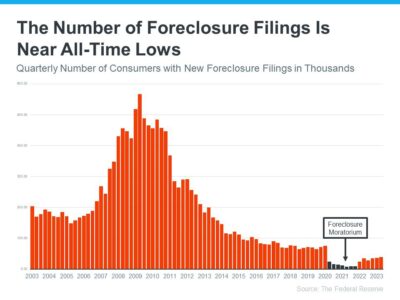

- Distressed Properties (Foreclosures and Short Sales): During the housing crisis of 2008, a flood of foreclosures inundated the market due to lax lending standards that allowed many individuals to obtain home loans they couldn't genuinely afford. Today, lending standards are significantly stricter, resulting in a higher number of qualified buyers and far fewer foreclosures. The following graph, sourced from the Federal Reserve, depicts how the landscape has evolved since the housing crash.

The graph vividly illustrates that as lending standards became more stringent and buyers more qualified, the number of foreclosures started to decline. Moreover, in 2020 and 2021, the combination of a foreclosure moratorium and the forbearance program played a pivotal role in preventing a recurrence of the foreclosure wave witnessed around 2008.

The forbearance program, in particular, was a game-changer, offering homeowners options such as loan deferrals and modifications that were not available previously. Data on the program's success reveals that four out of every five homeowners exiting forbearance have either paid in full or worked out a repayment plan to avoid foreclosure. These factors underscore why there won't be a sudden surge in foreclosures hitting the market.

What This Means for Los Angeles and Beverly Hills, CA: Now, let's take a closer look at what this inventory situation means for the bustling real estate markets in Los Angeles and Beverly Hills. These regions have always been in high demand due to their desirable locations, entertainment industry ties, and a unique blend of luxury and culture.

Inventory levels in Los Angeles and Beverly Hills are not anywhere close to where they would need to be for prices to experience a significant drop, and a housing market crash is not on the horizon. According to Bankrate, this situation is unlikely to change anytime soon, especially considering the persistent strength of buyer demand in these prestigious areas:

"This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won't allow a price crash in the near future."

Bottom Line: In summary, the housing market today, including the vibrant scenes in Los Angeles and Beverly Hills, is not poised for a repeat of the 2008 housing crisis. The critical takeaway from examining housing inventory is that there is no impending crash. The unique dynamics of low housing supply, increased caution among builders, and improved lending standards all contribute to a stable and thriving real estate market. So, if you're considering homeownership or investment in these sought-after areas, rest assured that the current conditions do not mirror those that led to the housing crash of 2008.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value.