What Lower Mortgage Rates Mean for Your Purchasing Power in the Los Angeles and Beverly Hills Real Estate Market

What Lower Mortgage Rates Mean for Your Purchasing Power in the Los Angeles and Beverly Hills Real Estate Market | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

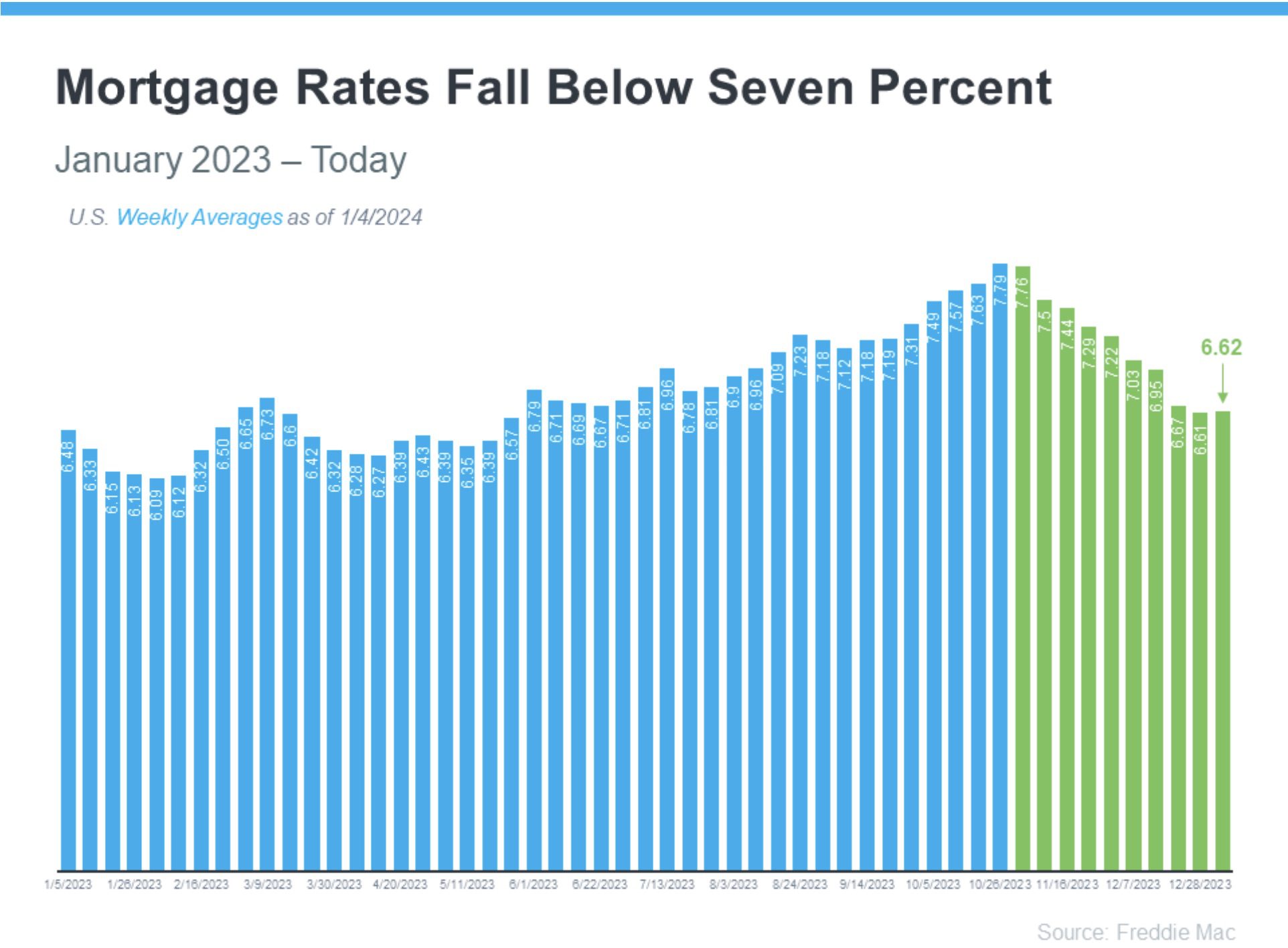

In the dynamic world of real estate, particularly in high-demand areas like Los Angeles and Beverly Hills, understanding the impact of mortgage rates on your purchasing power is key. Recently, there's been a significant development that prospective homeowners should take note of: the decrease in 30-year fixed mortgage rates. According to Freddie Mac, rates have dipped below 7% since the end of October, a trend that brings a wave of opportunity, especially in the bustling Los Angeles and Beverly Hills markets.

This trend is a beacon of positive news for buyers, especially in areas like Beverly Hills where the luxury market can be highly competitive. Bankrate's recent article echoes this sentiment, stating, “The rate cool-off somewhat eases the housing affordability squeeze.” Additionally, Edward Seiler, AVP of Housing Economics and Executive Director of the Research Institute for Housing America at the Mortgage Bankers Association (MBA), anticipates continued improvement in affordability as mortgage rates decline.

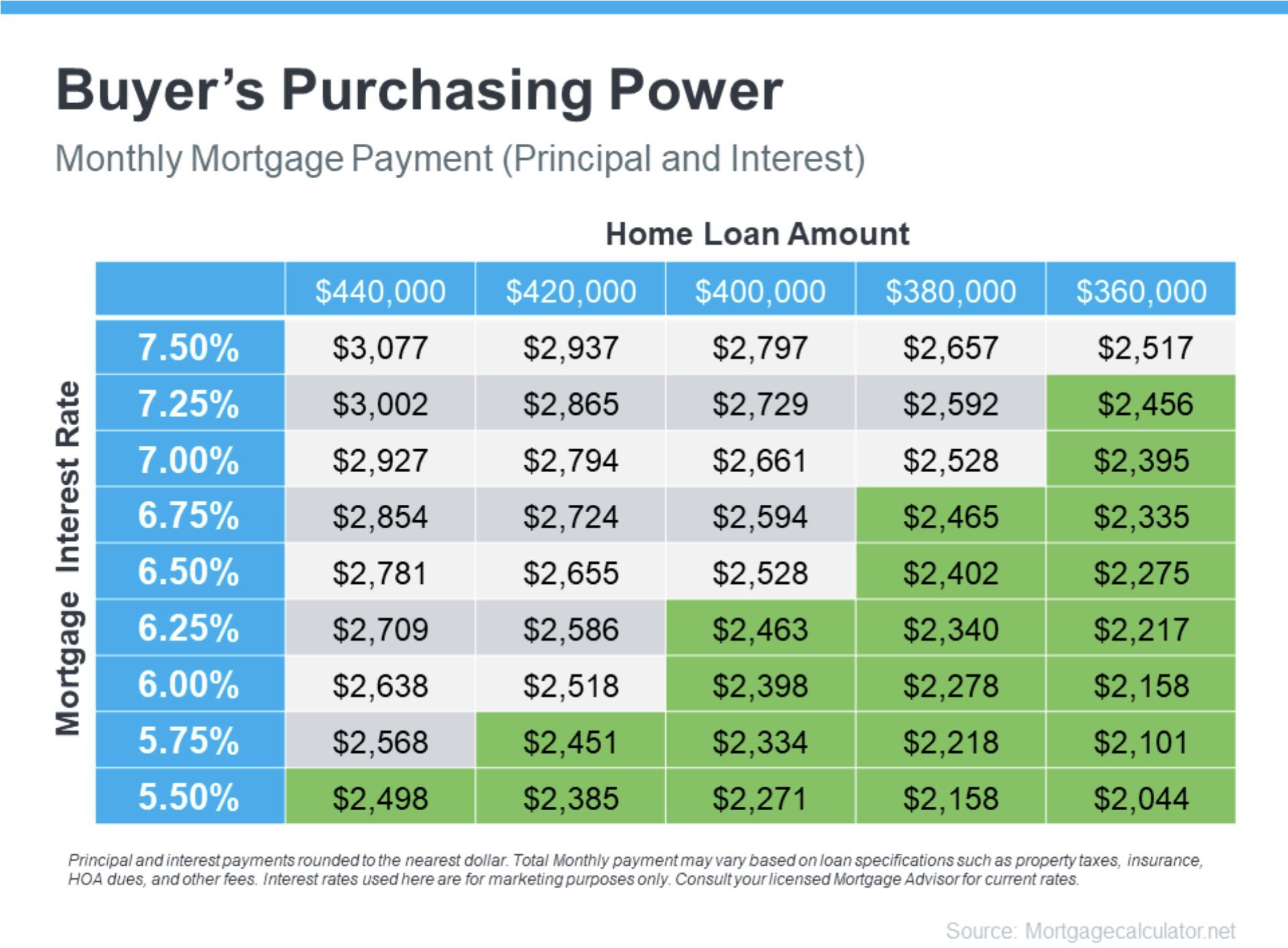

How Do Mortgage Rates Shape Your Home Search in Los Angeles and Beverly Hills? Grasping the relationship between mortgage rates and your monthly home payment is vital, more so in high-value areas like Beverly Hills and the greater Los Angeles region. The chart below depicts how shifts in mortgage rates can influence your budget and the loan amount you're eligible for. For instance, if you're targeting a monthly payment between $2,400 and $2,500, even minor rate fluctuations can significantly impact your purchasing capacity.

This insight is particularly crucial in Los Angeles and Beverly Hills, where the real estate market is diverse and dynamic. From the sprawling estates in Beverly Hills to the more varied housing options in Los Angeles, understanding how mortgage rates affect your buying power can open doors to properties and neighborhoods you might have thought were out of reach.

Leverage Expertise from Local Real Estate Professionals Navigating the Los Angeles and Beverly Hills real estate landscape requires the guidance of local experts. A real estate agent who knows the ins and outs of these areas, coupled with advice from a trusted lender, can offer invaluable insights. They'll help you explore mortgage options, understand the factors influencing rates, and how these changes can impact your buying journey in these prestigious locations.

By analyzing the latest data and adjusting your strategy based on the current rates, you'll be well-equipped to make informed decisions, whether you're eyeing a luxurious Beverly Hills property or a charming home in Los Angeles.

Bottom Line: A Golden Opportunity in Los Angeles and Beverly Hills For those looking to enter the Los Angeles and Beverly Hills real estate market, the recent downward trend in mortgage rates is a promising development. It's an opportune time to reassess your purchasing power and explore the possibilities in these sought-after areas. Let's connect and strategically plan your next steps towards owning a home in one of the most coveted regions in the country.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value.