Rising Home Prices in Los Angeles and Beverly Hills: What You Need to Know

Rising Home Prices in Los Angeles and Beverly Hills: What You Need to Know | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

If the thought of buying or selling a property in the luxurious neighborhoods of Los Angeles or Beverly Hills has ever crossed your mind, you know it's a process infused with a myriad of emotions—excitement, trepidation, and the weight of financial decision-making. Home prices can indeed be an emotional rollercoaster, and in high-stakes markets like these, the ride can be particularly nerve-wracking.

A Not-So-Temporary Upward Trend: What the Data Tells Us

Contrary to the fears of those who have hesitated to make a move, expecting the bubble to burst, home prices have been resilient, even in prime Los Angeles neighborhoods. The most recent data shows a consistent upward trajectory. To give you a clearer picture, let's dissect this trend:

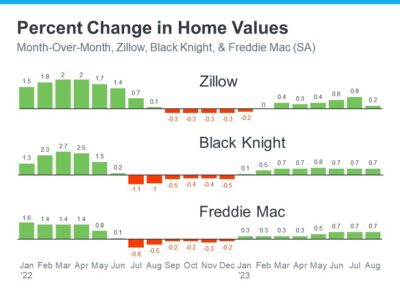

- In H1 2022, home prices experienced a meteoric rise, particularly in enclaves like Beverly Hills and Holmby Hills where luxury properties were trading hands for astronomical sums (reflected by the green bars on the left side of the graph).

- The second half of the year saw a market correction, with prices dipping slightly (as indicated by the red bars). However, these declines barely scratched the surface and were essentially fleeting.

- The media may have capitalized on this slight dip, creating a flurry of concern, but the truth is, 2023 has brought a more balanced but still positive price movement. Markets like Bel Air and Holmby Hills are experiencing a resurgence, albeit at a more sustainable pace (shown by the green bars on the right).

Orphe Divounguy, Senior Economist at Zillow, recently highlighted this national trend, stating:

"The U.S. housing market has surged over the past year after a temporary hiccup from July 2022-January 2023...That downturn has proven to be short-lived as housing has rebounded impressively so far in 2023..."

Analyzing the Upward Push: Supply and Demand in LA and Beverly Hills

While the national trends offer a macro perspective, localized factors like scarce land availability in Beverly Hills or Los Angeles' ever-expanding tech sector contribute to these unique markets. In addition, the mortgage rate lock-in effect plays an oversized role here. With prime properties at stake, homeowners in these regions are even more reluctant to relinquish their low mortgage rates, further contributing to low supply and keeping the prices buoyant.

The Buyer and Seller Impact: Capitalizing on Market Trends

For Buyers: If apprehensions about a falling market have held you back, now is a pivotal time to act. Properties in desirable areas like Beverly Hills rarely depreciate, making a home purchase a secure long-term investment.

For Sellers: If you've been on the fence about selling a property in elite LA neighborhoods due to fluctuating prices, know that the wind has shifted in your favor. Teaming up with a seasoned real estate agent can maximize your home's visibility and value, turning market trends to your advantage.

The Final Word

In summary, whether you’re in the national market or focused on upscale neighborhoods like Beverly Hills or Bel Air, there’s no reason to hold back based on fears of plummeting prices. If anything, these areas often defy broader market trends. A savvy real estate strategy can help you capitalize on the current upswing, transforming concerns about market volatility into a winning game plan.

Let's connect to deeply discuss how the shifting home prices can strategically benefit you in the elite neighborhoods of Los Angeles and Beverly Hills.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value.