Navigating the Real Estate Landscape: Why Los Angeles and Beverly Hills Defy Foreclosure Fears

Navigating the Real Estate Landscape: Why Los Angeles and Beverly Hills Defy Foreclosure Fears | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

Anticipating Mortgage Woes in the Face of Economic Challenges? Think Again.

In the midst of escalating costs across the board, from basic groceries to fuel for transportation, speculation has arisen regarding the ability of many individuals to meet their mortgage obligations. This has given rise to concerns that a surge of foreclosures might be imminent. While it's undeniable that there has been a slight uptick in foreclosure filings compared to the previous year, experts are quick to dismiss the notion of an impending deluge of foreclosures.

One voice of reason in this discourse is Bill McBride, the astute mind behind Calculated Risk. McBride's prowess in deciphering housing market trends allowed him to foresee the foreclosure debacle in 2008. Employing the same meticulous scrutiny and analytical prowess, he presents a different perspective on the current situation:

"We are not on the brink of another foreclosure crisis this time around." Let's delve into the rationale behind the improbability of another wave of foreclosures.

A Scarce Population of Mortgage Delinquents: During the previous housing market crash, one of the primary catalysts behind the surge in foreclosures was the lax lending standards that facilitated easy mortgage acquisition even for individuals with doubtful repayment capabilities. At that juncture, lenders were rather lenient in their evaluation of applicants' credit scores, income levels, employment status, and debt-to-income ratios.

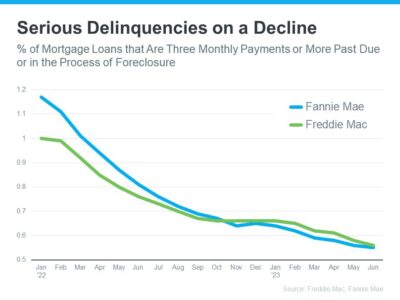

Contrastingly, contemporary lending standards have undergone stringent adjustments, resulting in a pool of homebuyers that encompasses a higher proportion of individuals capable of consistently fulfilling their mortgage obligations. Noteworthy data from Freddie Mac and Fannie Mae exemplifies this trend by illustrating a reduction in the number of homeowners significantly lagging behind on mortgage payments (refer to the appended graph):

Molly Boese, a distinguished Principal Economist at CoreLogic, underscores the rarity of homeowners grappling with mortgage repayment:

"As of May, the overarching mortgage delinquency rate achieved an unprecedented low, with serious delinquencies mirroring this trend. Moreover, the percentage of mortgages that were six months or more overdue, a worrisome statistic in 2021, has regressed to levels last witnessed in March 2020." The prerequisite for a considerable upswing in foreclosures entails an escalation in the number of individuals incapable of fulfilling their mortgage commitments. With a substantial proportion of current buyers diligently fulfilling their payment obligations, the prospects of a foreclosure wave appear dim.

In Conclusion: For those harboring concerns about an impending avalanche of foreclosures, rest assured that contemporary data does not substantiate this apprehension. In fact, qualified buyers are upholding their mortgage responsibilities at an exceptional rate, underscoring the stability of the housing market.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value