Navigating Mortgage Rates in Los Angeles and Beverly Hills: Past, Present, and Future

Navigating Mortgage Rates in Los Angeles and Beverly Hills: Past, Present, and Future | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

Mortgage Rates: A Comprehensive Look at the Past, Present, and Potential Future in Los Angeles and Beverly Hills, CA

For those aspiring to become homeowners in the vibrant real estate markets of Los Angeles and Beverly Hills, keeping a vigilant eye on mortgage rates is paramount. In cities where housing affordability can be a significant challenge, understanding the historical context of mortgage rates and their intersection with inflation can provide valuable insights into what the future may hold for prospective homebuyers.

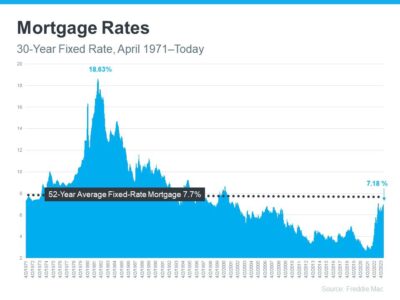

Providing Context to the Sticker Shock Since April of 1971, Freddie Mac has diligently tracked the 30-year fixed mortgage rate. On a weekly basis, they release the results of their Primary Mortgage Market Survey, which aggregates mortgage application data from lenders across the nation. (Refer to the graph below for a visual representation of this data):

When we examine the right side of the graph, it becomes evident that mortgage rates have experienced a notable upswing since the onset of the previous year. However, even with this upward trajectory, today's rates still reside below the 52-year historical average. While this historical perspective is valuable, prospective buyers in Los Angeles and Beverly Hills have grown accustomed to mortgage rates fluctuating between 3% and 5% over the past 15 years.

This historical backdrop explains why the recent surge in rates may have provoked a sense of sticker shock, even though they remain close to their long-term average. While many buyers have adapted to the elevated rates over the past year, a slight reduction in rates would undoubtedly be a welcome development. To ascertain the likelihood of such a scenario, we must delve into the realm of inflation.

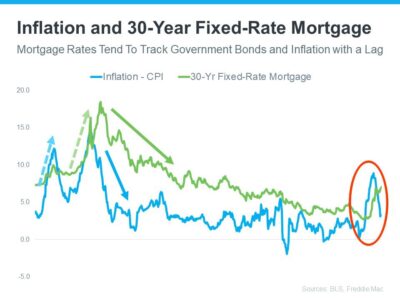

Where Could Mortgage Rates Be Headed in the Future? Since early 2022, the Federal Reserve has been diligently working to curb inflation. This is particularly significant because, historically, there has been a discernible connection between inflation and mortgage rates. (See the graph below for a visual representation of this correlation):

This graph beautifully illustrates the consistent relationship between inflation and mortgage rates. Focusing on the left side of the graph, it becomes evident that each time inflation undergoes a significant shift (indicated in blue), mortgage rates follow suit shortly afterward (indicated in green).

The circled portion of the graph underscores the most recent inflation surge, with mortgage rates closely trailing behind. As inflation has moderated somewhat in the current year, mortgage rates have not yet mirrored a similar decrease.

Consequently, if history serves as our guide, it suggests that the market anticipates mortgage rates to align with inflation and potentially recede in the near future. While it is impossible to provide a precise prediction of future mortgage rates, the alignment of moderating inflation with decreasing mortgage rates fits well within an established trend.

In Conclusion: To gain insights into the potential trajectory of mortgage rates, it is invaluable to examine their historical patterns. In the context of Los Angeles and Beverly Hills, where real estate markets can be particularly dynamic, recognizing the connection between inflation and mortgage rates is crucial. If this historical relationship holds true, the recent moderation in inflation could spell favorable news for the future of mortgage rates, potentially making homeownership more attainable for those seeking to invest in these coveted locales.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value.