Navigating Down Payments in LA: Should Your 401(k) Open the Door to Beverly Hills Real Estate

Navigating Down Payments in LA: Should Your 401(k) Open the Door to Beverly Hills Real Estate | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

As you envision the keys to your own Los Angeles or Beverly Hills home in hand, the question of financing, particularly the down payment, becomes paramount. The idea of tapping into your 401(k) for this significant life milestone might cross your mind, especially when the vibrant Los Angeles real estate market beckons with its array of stylish residences from the heart of the city to the lush streets of Beverly Hills.

However, before redirecting your retirement funds towards a down payment, it's critical to scrutinize all possible avenues and consult with a financial advisor. The figures in your 401(k) might be encouraging, but withdrawal penalties and long-term financial impacts warrant a comprehensive evaluation.

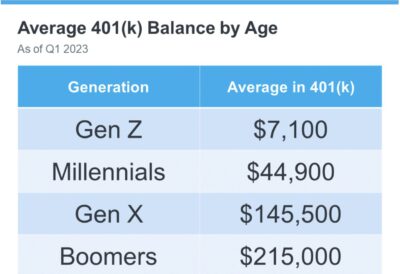

The Lure of the Numbers Considerable retirement savings, as seen in the graph below, may indeed make the prospect of using your 401(k) for a real estate purchase quite alluring:

The Real Estate Perspective In Los Angeles and Beverly Hills, where the real estate market has consistently showcased a robust performance, investing in property might seem like a sure-fire wealth-building strategy. However, the implications of using retirement funds to break into these competitive markets should be weighed against potential benefits.

Exploring Alternatives for Home Financing: Rather than tapping into your 401(k), you might want to explore other financing methods. For instance:

FHA Loan: These loans offer lower down payments, potentially as little as 3.5%, subject to your creditworthiness. Down Payment Assistance: In LA and Beverly Hills, various programs exist to support both first-time and repeat buyers in affording a down payment. Strategic Planning is Paramount Engaging with financial experts to devise a solid strategy is crucial before embarking on your home-buying journey, especially in high-stakes markets like Los Angeles and Beverly Hills. Kelly Palmer, a financial strategist, advises:

"It's common for potential homeowners to halt their retirement contributions aiming to secure a larger home, perhaps banking on refinancing opportunities down the line. Provided that there's a clear strategy to resume retirement savings, exploring the spectrum of homeownership options is a wise move."

In Conclusion: Before using your 401(k) for a down payment in Los Angeles or Beverly Hills' distinguished property market, carefully consider every alternative and consult with a financial professional. Remember, the path to homeownership should be paved with informed decisions and strategic planning.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value.