Leveraging Home Equity in the Los Angeles and Beverly Hills Real Estate Markets

Leveraging Home Equity in the Los Angeles and Beverly Hills Real Estate Markets | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

Deciding whether to sell your home in the competitive landscapes of Los Angeles and Beverly Hills can be daunting, especially with current market conditions. However, an often-overlooked asset, your home equity, could be the deciding factor. As defined by Bankrate, home equity is the portion of your property you truly "own" — the value of your home minus any mortgage balance. Initially established through your down payment and subsequently increased through mortgage payments and property value appreciation, equity is essentially your home's net worth.

In recent years, the Los Angeles and Beverly Hills areas have seen significant increases in home values, boosting homeowner equity substantially. CoreLogic highlights that the average homeowner with a mortgage has amassed over $300,000 in equity, a testament to the robust growth in these premium markets.

The Power of Equity in Your Next Move

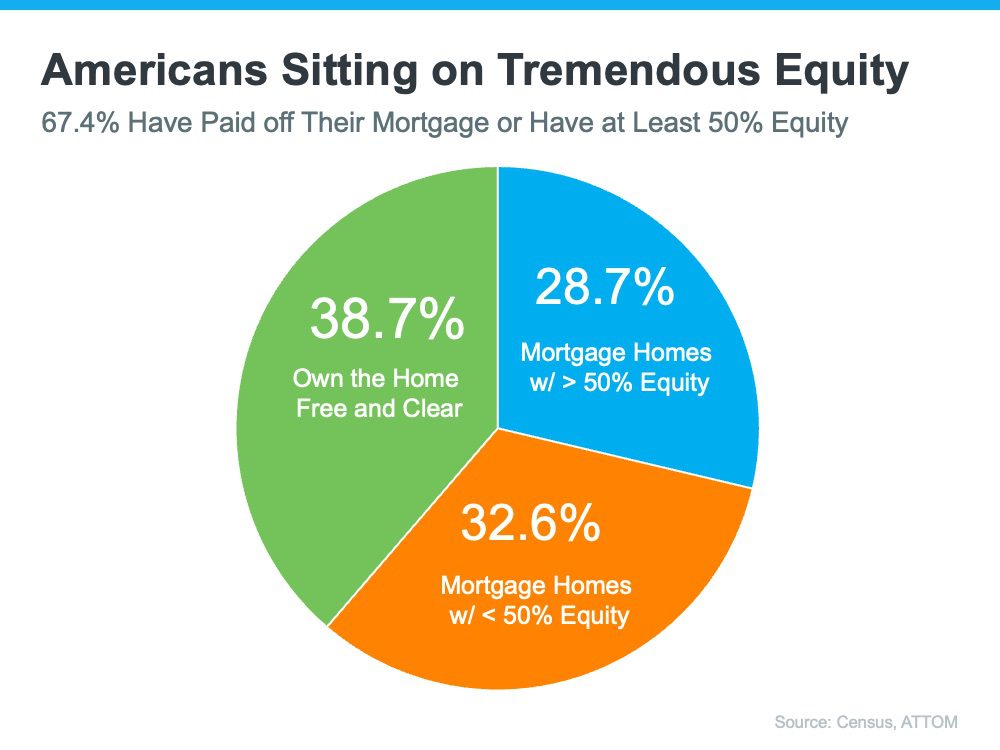

For homeowners contemplating a sale in Los Angeles or Beverly Hills, this accrued equity is not just a number but a powerful tool for your next real estate venture. Census and ATTOM data reveal that approximately 70% of homeowners are sitting on a goldmine of equity, with either complete ownership or at least 50% equity in their homes.

Becoming an All-Cash Buyer

In the fiercely competitive Los Angeles and Beverly Hills markets, leveraging your equity to become an all-cash buyer could set you apart. This position eliminates the need for mortgage borrowing, making you more attractive to sellers and potentially saving you from the complexities of mortgage interest. Investopedia notes the advantages of paying cash in such scenarios, including a stronger bargaining position and savings on interest.

Making a Larger Down Payment

Alternatively, your equity could serve as a substantial down payment on your next purchase, allowing for a smaller loan size and possibly better loan terms. The Mortgage Reports suggest that larger down payments can result in more favorable interest rates, reducing overall borrowing costs.

Discovering Your Home's Equity

To understand the full scope of your equity, consider obtaining a Professional Equity Assessment Report (PEAR) from a trusted real estate agent. This step is especially crucial in high-value areas like Los Angeles and Beverly Hills, where market dynamics can significantly impact property values.

Bottom Line: Equity as Your Strategic Advantage

In the affluent neighborhoods of Los Angeles and Beverly Hills, your home equity is not just a reflection of your financial investment but a strategic advantage for your future real estate endeavors. Whether you're aiming to upgrade, downsize, or simply change locales within these iconic cities, leveraging your equity can facilitate a smoother transition. If you're contemplating a move, let's connect to explore how your home equity can serve as a cornerstone for your next chapter in these premier California markets.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value