Inflation’s Impact on Home buying: Unraveling Mortgage Rates in Los Angeles and Beverly Hills

Inflation's Impact on Home buying: Unraveling Mortgage Rates in Los Angeles and Beverly Hills | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

When delving into housing market news, particularly if you're eyeing the Los Angeles and Beverly Hills real estate scenes, you might come across discussions about decisions made by the Federal Reserve (the Fed) and their ripple effects. But how do these decisions intersect with your aspirations of homeownership in these glamorous Californian locales? Here's a comprehensive breakdown of what you need to grasp.

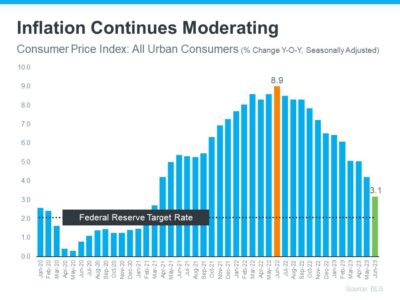

Amidst the headlines, the Fed remains committed to taming inflation. Despite a consecutive 12-month period of inflation cooling down (as indicated in the graph below), the most recent data demonstrates that it still lingers above the Fed's targeted 2% threshold:

In a region where luxury properties and prime real estate are prevalent, it's natural to wonder how these fluctuations impact your homeownership journey. While optimism might have prompted expectations that the Fed would halt its efforts, given their progress in curbing inflation, their cautious approach stems from the concern that premature cessation could trigger an inflation resurgence. This apprehension led to the Fed's recent decision to further elevate the Federal Funds Rate, a move endorsed by Jerome Powell, the Chairman of the Fed, who affirms:

“Our commitment remains unwavering in returning inflation to our designated 2 percent, and in maintaining firm anchoring of long-term inflation expectations.”

Greg McBride, the Senior VP and Chief Financial Analyst at Bankrate, offers insights into the interplay between elevated inflation, a robust economy, and the Fed's recent course of action:

“Despite the persistent inflation, the economy displays remarkable resilience, and the labor market retains its vigor. However, this may inadvertently contribute to the stubbornly high inflation. Consequently, the Fed deems it necessary to exercise a more cautious monetary approach.”

Though a hike in the Federal Fund Rate might not directly dictate mortgage rate movements, its repercussions are indeed felt. A recent article by Fortune underscores this connection:

“The federal funds rate serves as the benchmark interest rate governing interbank lending. When inflation exhibits an upward trajectory, the Fed counteracts by heightening rates, thereby increasing borrowing costs and applying the brakes on economic acceleration. Conversely, during phases of subdued inflation, the Fed reduces rates to galvanize economic activity and stimulate growth.”

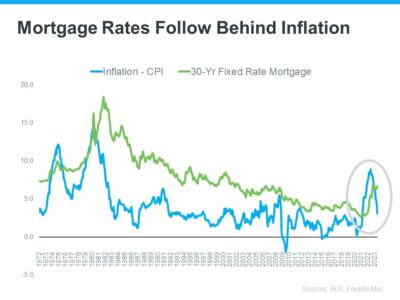

So, how does this intricate dance between the Fed and inflation influence your prospects in the Los Angeles and Beverly Hills real estate markets? The correlation is straightforward: elevated inflation translates to elevated mortgage rates. However, if the Fed achieves its goal of reining in inflation, the outcome could pave the way for diminished mortgage rates, rendering homeownership within these glamorous locales a more attainable goal.

Illustrated by the graph below, the linkage between inflation (depicted in the blue trend line) and mortgage rates (charted by the green trend line) becomes clearer. As history unfolds, a downtrend in inflation often correlates with a downward trajectory in mortgage rates:

As the data encapsulated above underscores, as the blue trend line indicating inflation gradually descends, the subsequent response in mortgage rates—marked by the green trend line—tends to mirror this trend. McBride offers an insight into the prospective course of mortgage rates:

“Amid the backdrop of subsiding inflation pressures, a pattern of consistent mortgage rate declines is foreseeable throughout the year. This forecast holds particularly true should the economy and labor market display discernible deceleration.”

Conclusively, the dynamic that shapes mortgage rates hinges fundamentally upon inflation. A cooling down of inflation inevitably ushers in the prospect of reduced mortgage rates. If you're contemplating homeownership in the opulent enclaves of Los Angeles and Beverly Hills, engage in a conversation with us. Our expert insights into market shifts will empower you to decipher their implications on your homeownership endeavors. Your dream home in these illustrious Californian neighborhoods might be more within reach than you think.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value