Home Prices in Los Angeles and Beverly Hills: Slow Growth, Not a Crash

In a market as dynamic as Los Angeles—especially in luxury enclaves like Beverly Hills—real estate headlines often stir up drama. Lately, you may have seen doomsday predictions of a housing crash. But let’s set the record straight: the actual data paints a much calmer and more encouraging picture for both homeowners and buyers.

What the Experts Are Really Saying

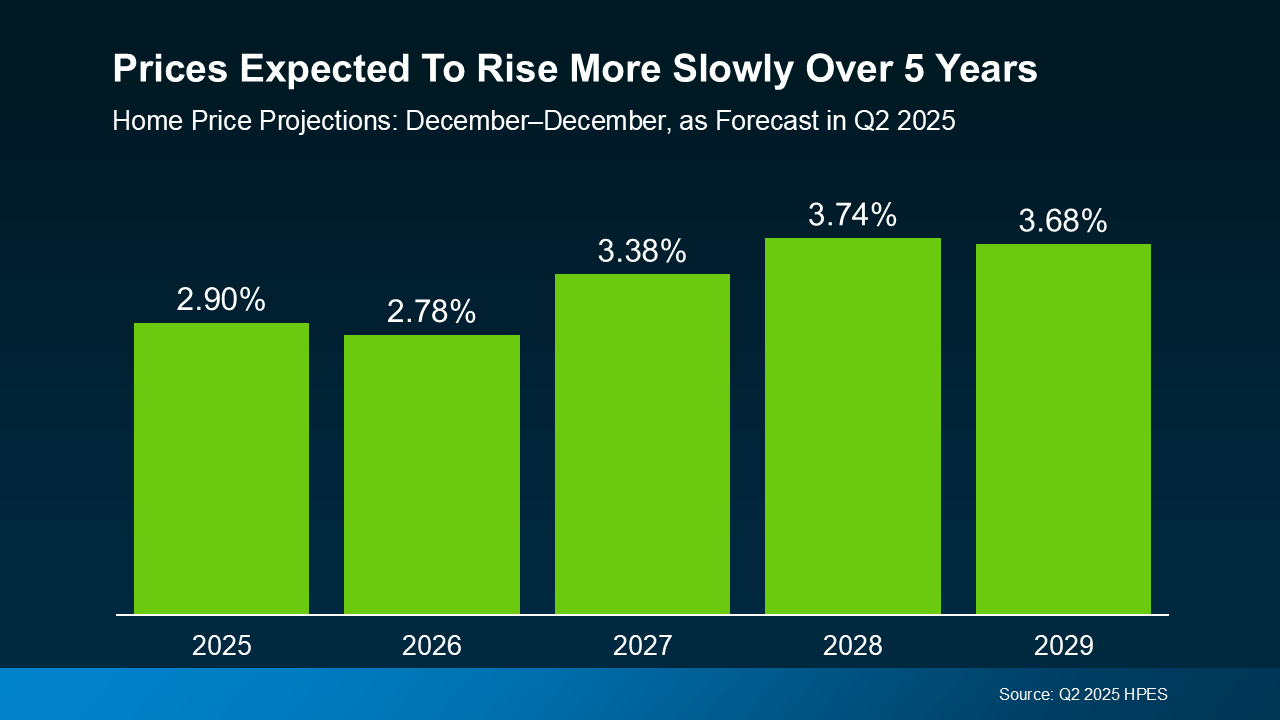

The latest Q2 2025 Home Price Expectations Survey (HPES), which compiles insights from over 100 top housing market economists and analysts, confirms one key trend: home prices are expected to continue rising steadily through 2029, just at a more moderate pace than during the pandemic-fueled frenzy.

Across the U.S., and especially in high-demand areas like Beverly Hills, Bel-Air, and Los Feliz, prices aren’t crashing—they’re normalizing.

Take a look at the national 5-year projections:

-

2025: +2.9%

-

2026: +2.78%

-

2027: +3.38%

-

2028: +3.74%

-

2029: +3.68%

While this represents slower growth than recent years, it’s steady, sustainable, and far from a collapse.

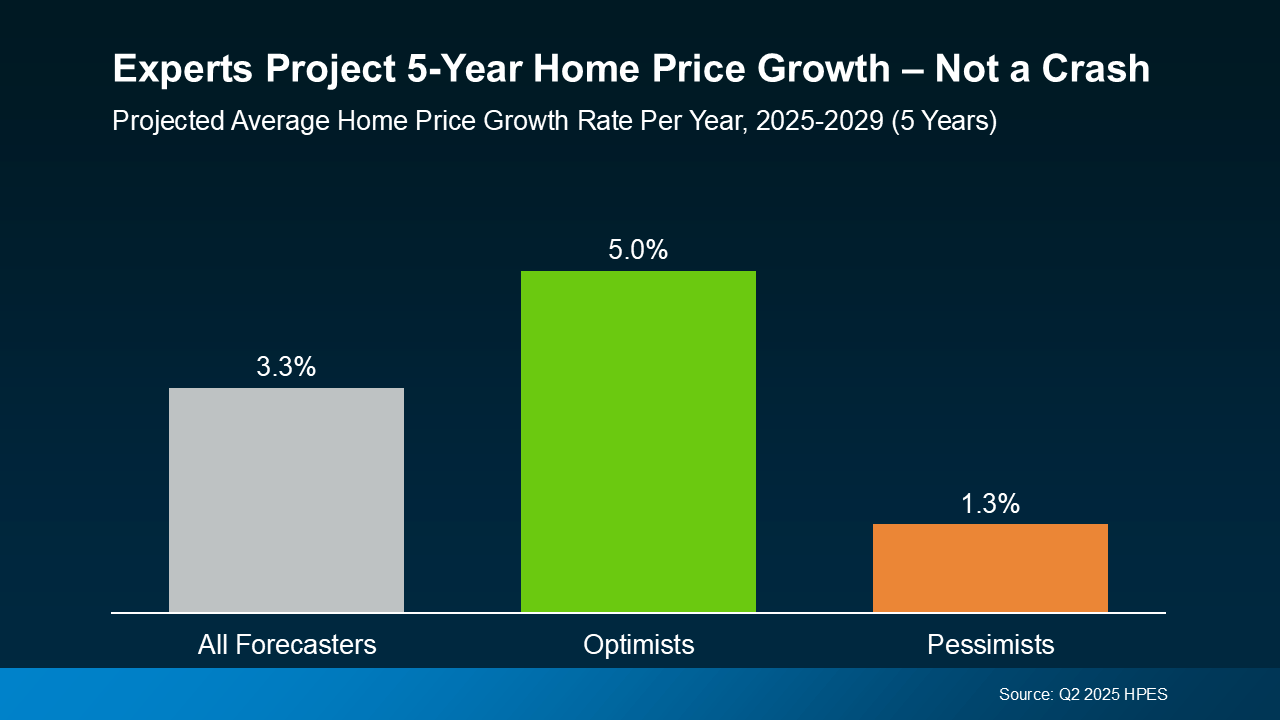

What About Varying Forecasts?

As with any financial forecast, opinions vary:

-

Optimists project annual growth of 5.0%

-

Pessimists still expect 1.3% growth

-

Average across all experts: 3.3% annual increase

The key takeaway? Not one group is predicting a crash.

That’s because the fundamentals remain strong:

-

Lending standards are tight—not reckless like in 2008.

-

Inventory remains limited, particularly in luxury sectors like Beverly Hills.

-

Homeowners are sitting on historically high equity, reducing the risk of foreclosures or forced sales.

-

There is still strong demand for quality properties in premium LA neighborhoods.

What This Means for Beverly Hills and Los Angeles

In hyperlocal markets like Beverly Hills, Brentwood, and the Hollywood Hills, where demand from international buyers, celebrities, and high-net-worth individuals remains robust, we often see appreciation that outpaces national averages. Even if prices level off briefly, the long-term outlook is bullish.

More inventory may soften prices slightly in some micro-neighborhoods, but don’t mistake that for a downturn. These are normal market adjustments, not the signs of a bubble bursting.

Bottom Line

If you're waiting for the “perfect moment” or hoping for a crash to score a deal, it’s time to recalibrate. The data simply doesn’t support a major drop ahead. What we’re seeing is a return to normal, balanced growth, especially in premier markets like Beverly Hills and Los Angeles.

Whether you're thinking of selling at the top of your equity or buying before appreciation accelerates again, your timing could be excellent.

Let’s dive into what this means for your zip code. National trends set the tone—but in real estate, local is everything.

Contact me today for a personalized market update and valuation. Let’s strategize your next move in one of the world’s most iconic real estate markets.