Expert Housing Market Forecasts for the Second Half of the Year | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

Expert Housing Market Forecasts for the Second Half of the Year | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

The housing market is at a turning point, and if you’re thinking of buying or selling a home, that may leave you wondering: is it still a good time to buy a home? Should I make a move this year? To help answer those questions, let’s turn to the experts for projections on what the second half of the year holds for residential real estate.

Where Mortgage Rates Will Go Depends on Inflation

While one of the big questions on all buyers’ minds is where will mortgage rates go in the months ahead, no one has a crystal ball to know exactly what’ll happen in the future. What housing market experts know for sure is that the record-low mortgage rates during the pandemic were an outlier, not the norm.

This year, rates have climbed over 2% due to the Federal Reserve’s response to rising inflation. If inflation continues to rise, it’s likely that mortgage rates will respond. Greg McBride, Chief Financial Analyst at Bankrate, explains it well:

“Until inflation peaks, mortgage rates won’t either. Without improvement on the inflation front, we don’t know where the interest rate ceiling will be.”

Whether you’re buying your first home or selling your current house to make a move, today’s mortgage rate is an important factor to consider. When rates rise, they impact affordability and your purchasing power. That’s why it’s crucial to work with a team of professionals, so you have expert advice to help you make an informed decision about your best move.

The Supply of Homes for Sale Projected To Continue Increasing

This year, particularly this spring, the number of homes for sale has grown. That’s partly due to more homeowners listing their houses, but also because higher mortgage rates have helped ease the intensity of buyer demand. Moderating buyer demand slows down the pace of home sales, which in turn helps inventory rise.

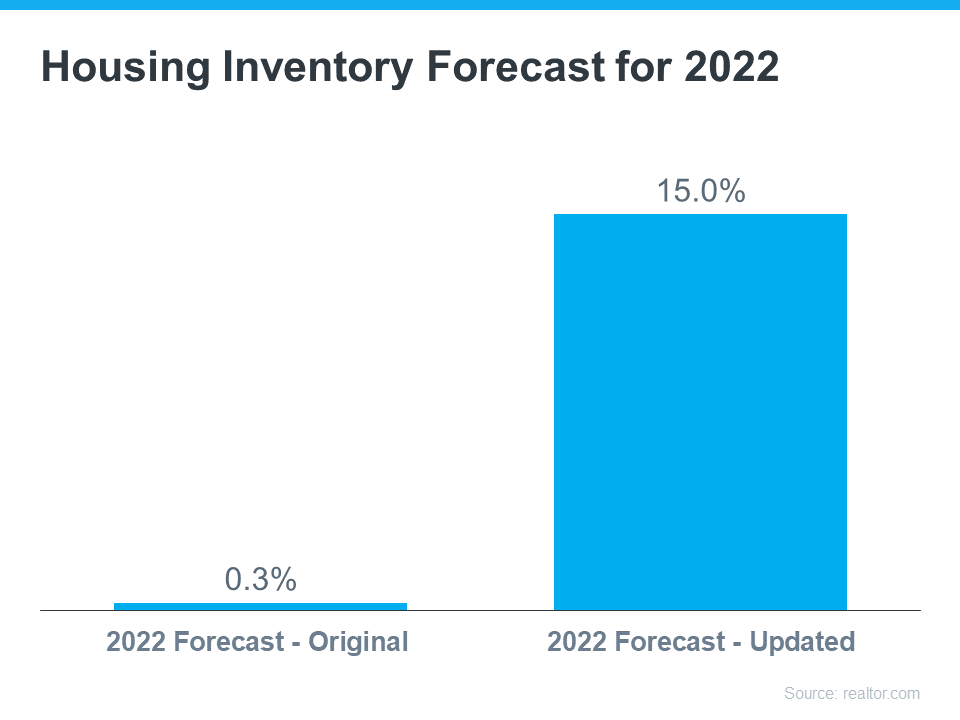

Experts say that growth will continue. Recently, realtor.com updated their 2022 inventory forecast. In the latest release, they increased their projections for inventory gains dramatically, going from a 0.3% increase at the beginning of the year to a 15.0% jump by the end of 2022 (see graph below):

More homes to choose from is great news if you’re craving more options for your home search – just know that there isn’t a sudden surplus of inventory on the horizon. Housing supply is still low, so you’ll need to partner with an agent to stay on top of what’s available in your market and move fast when you find the one. It’s not going to be easy to find a home, but it certainly won’t be as difficult as it has been over the past two years.

Home Price Forecasts Call for Ongoing Appreciation

Due to the imbalance between the number of homes for sale and the number of buyers looking to make a purchase, the pandemic led to record-breaking increases in home prices. According to CoreLogic, homes appreciated by 15% in 2021, and they’ve continued to rise this year.

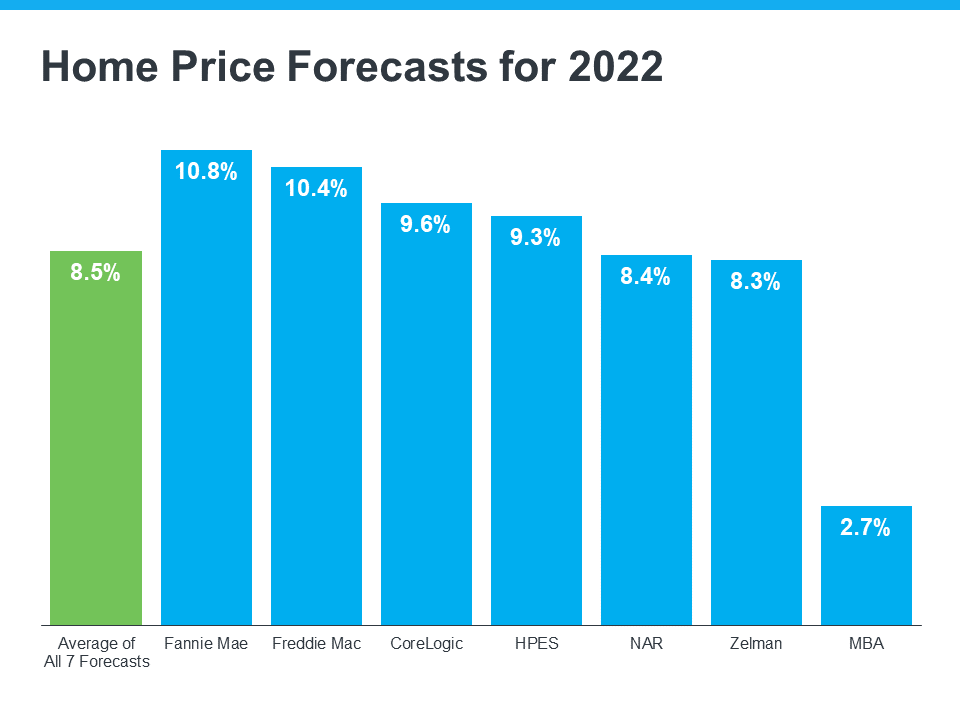

Even though housing supply is increasing today, there are still more buyers than there are homes for sale, and that’s maintaining the upward pressure on home prices. That’s why experts are not calling for prices to decline, rather they’re forecasting they’ll continue to climb, just at a more moderate pace this year. On average, homes are projected to appreciate by about 8.5% in 2022 (see graph below):

Selma Hepp, Deputy Chief Economist at CoreLogic, explains why the housing market will see deceleration, but not depreciation, in prices:

“The current home price growth rate is unsustainable, and higher mortgage rates coupled with more inventory will lead to slower home price growth but unlikely declines in home prices.”

For current homeowners looking to sell, know your home’s value isn’t projected to fall, but waiting to make your purchase does mean your next home could cost more as home prices continue to appreciate. That’s why, if you’re thinking about buying your first home or you’re ready to make a move, it may make sense to do so now before prices climb higher. But rest assured, once you buy a home, that price appreciation will help grow the value of your investment.

Bottom Line

Whether you’re a homebuyer or seller, you need to know what’s happening in the housing market, so you can make the most informed decision possible. Let’s connect to discuss your goals and what lies ahead, so you can determine the best plan for your move.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE"

or click "HERE" to estimate your home value