Deciphering Mortgage Rate Fluctuations: Insights for Navigating Los Angeles and Beverly Hills Real Estate

Deciphering Mortgage Rate Fluctuations: Insights for Navigating Los Angeles and Beverly Hills Real Estate | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

Navigating the fluctuations of mortgage rates can be perplexing, especially amidst the diverse narratives surrounding the Los Angeles and Beverly Hills real estate markets. You might have encountered varying reports—some suggesting mortgage rates are decreasing, while others claim they're on the rise. This disparity in information stems from different analytical timeframes, leading to confusion about the current state of mortgage rates.

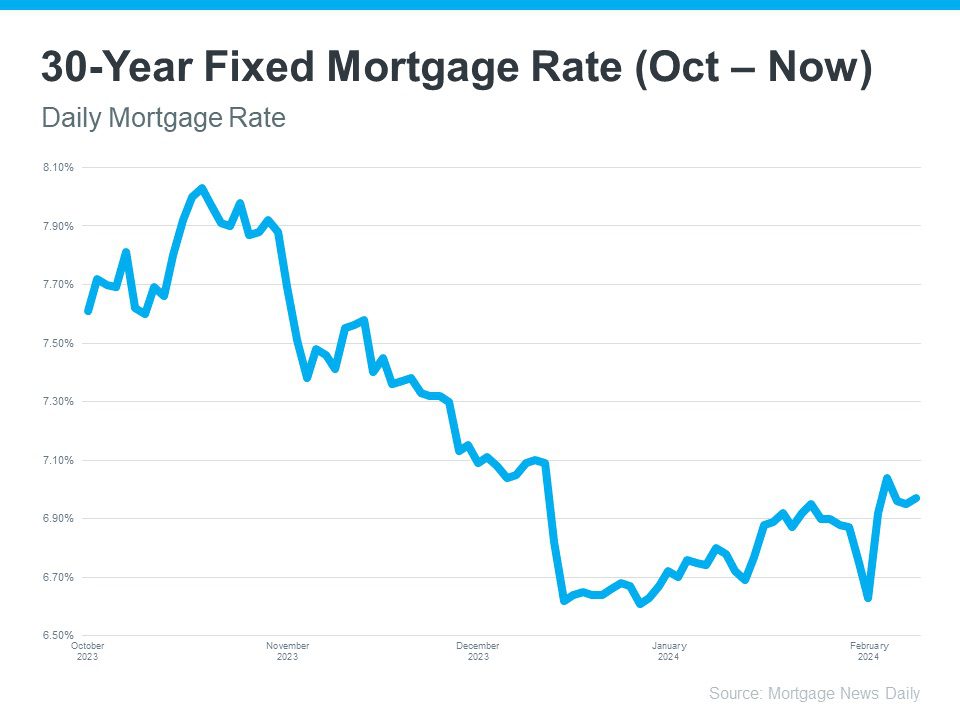

Mortgage rates are inherently volatile, influenced by a myriad of factors including economic conditions, Federal Reserve decisions, and global events, causing frequent shifts that reflect the economic and political climate. This volatility is illustrated through the peaks and valleys of the 30-year fixed mortgage rate trends provided by Mortgage News Daily. The graph vividly displays the rate's fluctuations over recent months, underscoring the complexity of predicting short-term movements.

In the context of Los Angeles and Beverly Hills—areas synonymous with luxury real estate and significant financial investments—the interpretation of mortgage rate trends is particularly crucial for buyers and sellers. For instance, a short-term analysis might suggest an uptick in rates, whereas a broader view from last October to the present indicates a general downtrend. This broader perspective reveals that, despite the daily fluctuations, mortgage rates have generally decreased from their peak last year, offering potential relief to homebuyers in these premium markets.

Understanding the big picture is essential when navigating the real estate markets of Los Angeles and Beverly Hills. Focusing on the minor day-to-day changes can be misleading; instead, acknowledging the overall downward trend in mortgage rates since last year provides a more accurate reflection of the current market conditions. This trend is particularly noteworthy for those considering purchasing homes in these areas, where the luxury market demands careful financial planning and awareness of mortgage rates.

In conclusion, while mortgage rates will continue to experience fluctuations, the overarching trend points to a decrease from the highs of last year, offering a potentially favorable environment for buyers in the Los Angeles and Beverly Hills real estate markets. If you're contemplating entering these markets or have questions about the current state of mortgage rates, connecting with a knowledgeable real estate professional can provide clarity and guide your decisions in these prestigious locales.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value