2 Key Reasons the Current Mortgage Rate Trend Benefits Sellers in Los Angeles and Beverly Hills

2 Key Reasons the Current Mortgage Rate Trend Benefits Sellers in Los Angeles and Beverly Hills | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert.

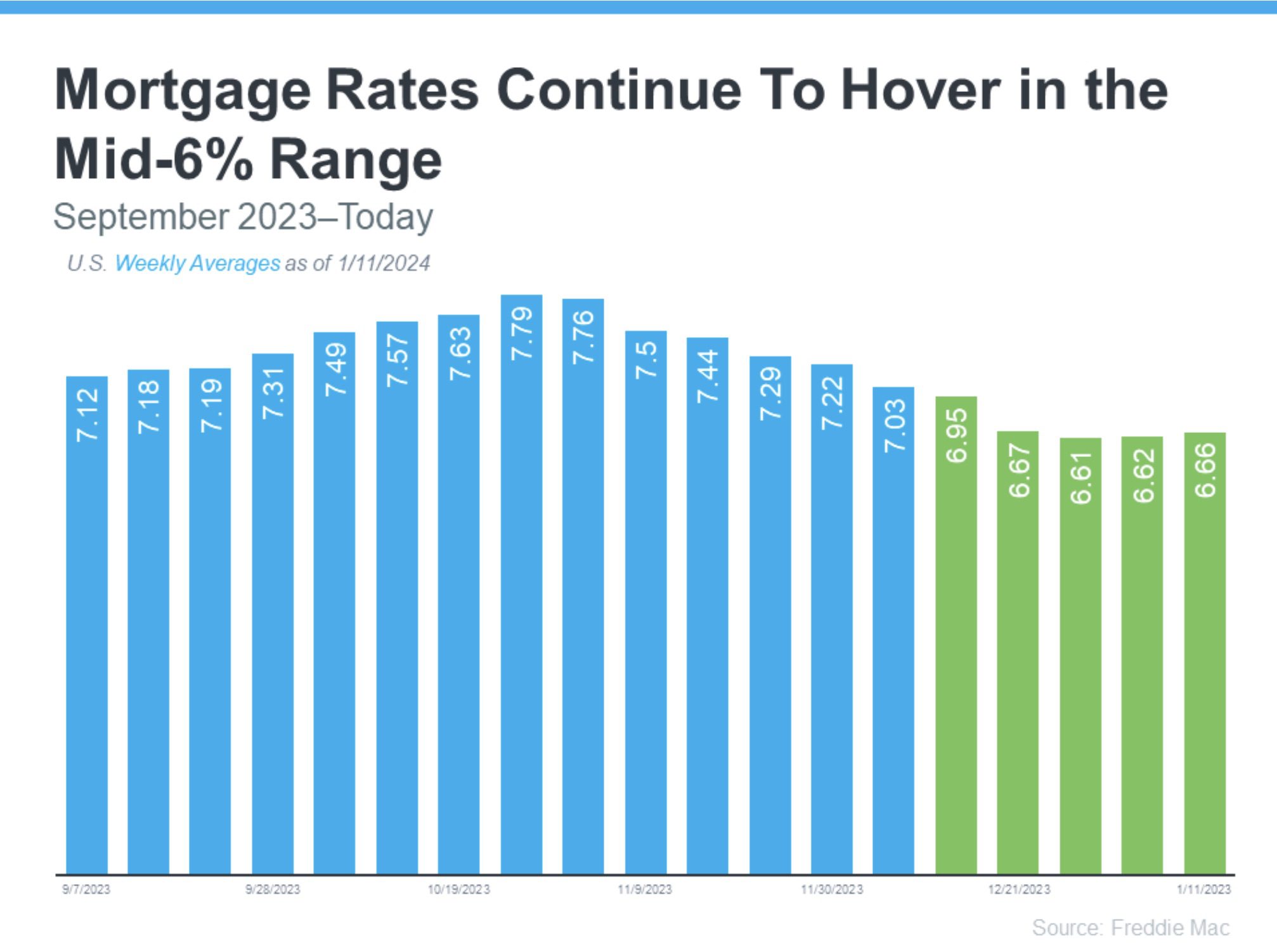

If you're a homeowner in the prestigious areas of Los Angeles or Beverly Hills and have been hesitant to sell due to high mortgage rates, the recent downward trend in rates is a beacon of good news. Since peaking at 7.79% last October, mortgage rates have consistently stayed below 7%, a significant shift from the 'unicorn' years of 3%.

Dean Baker, Senior Economist at the Center for Economic Research, notes: “Mortgage rates are on the decline again. We may not see the pandemic lows, but rates under 6.0 percent are likely, which is low by pre-Great Recession standards.”

Here are two reasons why this trend is particularly advantageous for sellers in the LA and Beverly Hills real estate markets:

1. Reduced 'Lock-In' Effect for Current Homeowners

In the luxury markets of Los Angeles and Beverly Hills, the recent drop in mortgage rates means less of a 'lock-in' effect to your current rate. Previously, moving from one high-value property to another meant potentially trading a low rate for one as high as 8%. Now, with rates lowering, the gap between your current and new mortgage rate shrinks, making the move more financially viable.

Lance Lambert, Founder of ResiClub, highlights: “With the declining rates, sellers in high-end markets like Beverly Hills might reconsider the 'lock-in effect' and see opportunities to upgrade or change lifestyles.”

2. Increased Buyer Interest in the Market

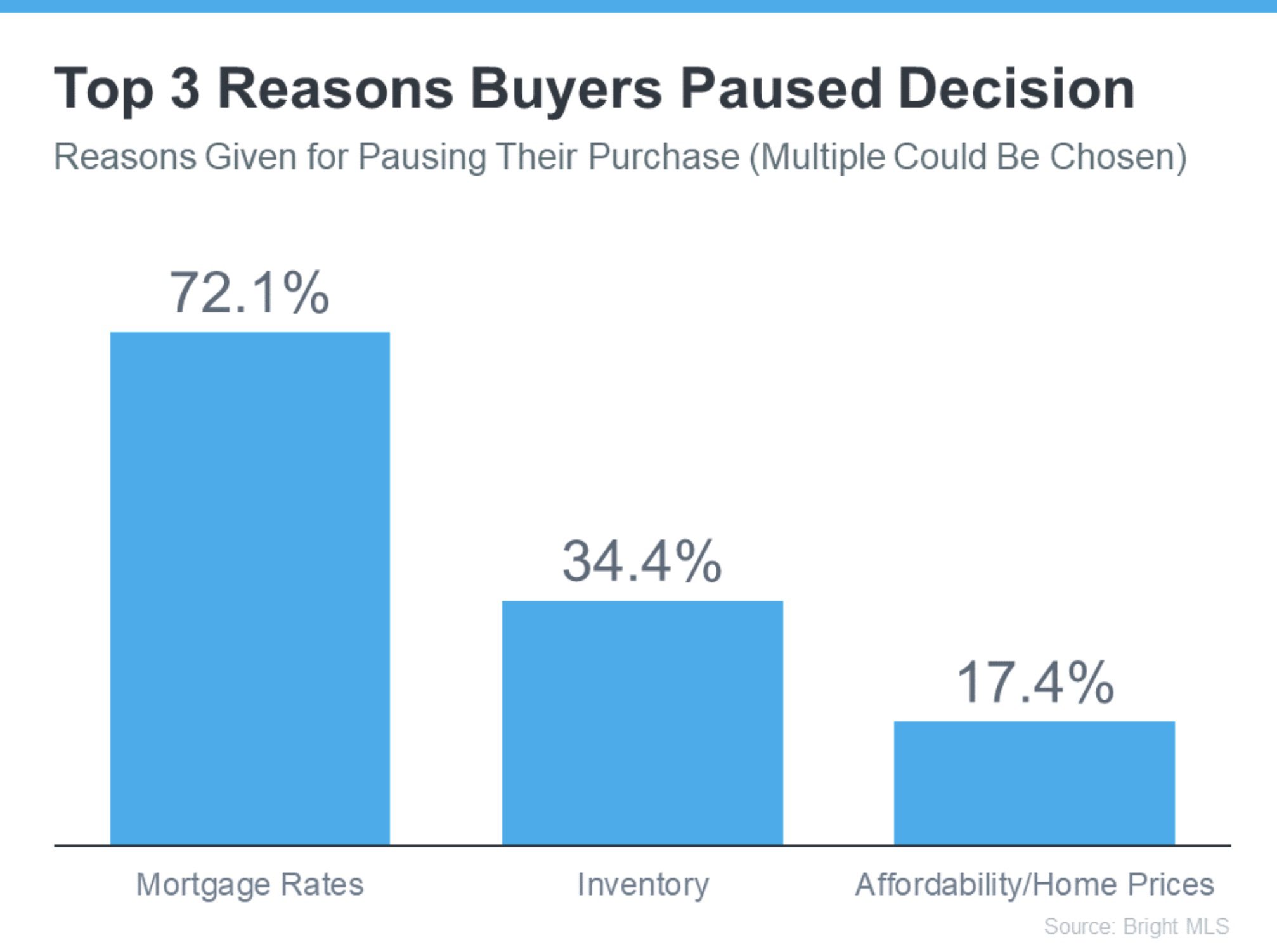

Bright MLS data indicates high mortgage rates were a primary deterrent for buyers. With rates easing, owning a home in exclusive areas like Beverly Hills and Los Angeles becomes more attainable. Lower rates mean lower loan costs, making the prospect of purchasing a luxury home more appealing. This translates to an increase in demand for your property as more buyers re-enter the market, ready to invest in these elite neighborhoods.

Bottom Line

For those in Los Angeles and Beverly Hills, the decline in mortgage rates signals an opportune moment to sell. If you've been waiting for the right time to sell your luxury home due to concerns about mortgage rates or buyer availability, this might be the turning point. When you're ready to make a move in these highly sought-after markets, let’s connect and explore the possibilities that await in the current real estate landscape.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value