Why LA and Beverly Hills Aren’t Facing a Foreclosure Crisis: An In-Depth Look

Why LA and Beverly Hills Aren’t Facing a Foreclosure Crisis: An In-Depth Look | Christophe Choo at Coldwell Banker Global Luxury is Your Local Real Estate Expert

Introduction

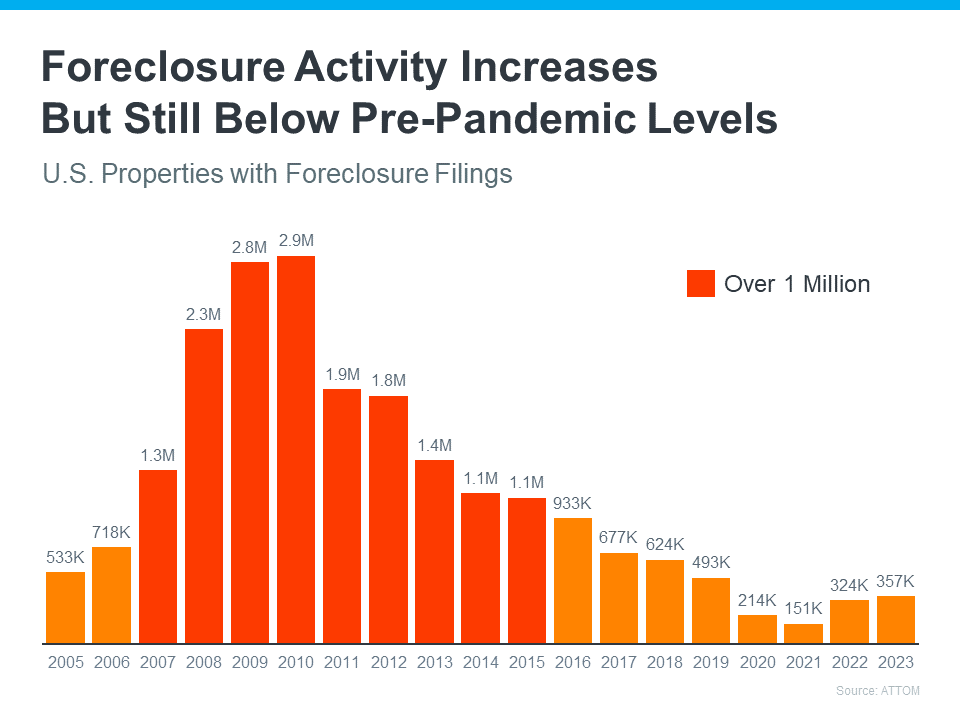

Recent headlines about rising foreclosure numbers might have caught your attention, sparking concerns about a potential repeat of the 2008 housing crash. However, a closer look at the data, particularly in affluent markets like Los Angeles and Beverly Hills, provides a reassuring contrast to those fears.

Foreclosure Trends: National vs. Local

Nationally, while there is an uptick in foreclosure filings as forbearance programs end, this increase is not indicative of a market crisis but rather a return to pre-pandemic normalcy. In Los Angeles and Beverly Hills, the situation is even more stable. These areas have historically low foreclosure rates, thanks to high property values and significant homeowner equity.

Media Misrepresentation

Much of the concern stems from media reports that compare current foreclosure rates to those during unprecedented lows during the pandemic. This comparison can be misleading. It's important to understand that the slight increase in foreclosures is a normalization following the end of pandemic-related moratoriums, not a sign of widespread distress.

Historical Context and Current Comparisons

Looking back to the 2008 crash, foreclosure activity was dramatically higher, with over a million filings nationally each year. In contrast, in 2023, the number was approximately 357,000. This is particularly relevant to areas like Beverly Hills and Los Angeles where, even in the current climate, the market dynamics are significantly different. Homeowners in these regions typically possess substantial equity, reducing the risk of foreclosure despite market fluctuations.

The Role of Equity

A key factor distinguishing today's situation from 2008 is the level of homeowner equity. In markets like Los Angeles and Beverly Hills, many homeowners have built up considerable equity, buffering them against the need to foreclose even if property values temporarily dip. According to Bankrate, unlike during the housing crash, the current market does not have a glut of foreclosures depressing property values, further stabilizing these high-end areas.

Conclusion

For residents and potential buyers in Los Angeles and Beverly Hills, the current uptick in foreclosures should not be a cause for alarm. The market conditions here differ greatly from the national landscape, and they're bolstered by strong property values and homeowner equity. It's essential to put the data into context—today’s market is not headed towards a foreclosure crisis but is simply adjusting post-pandemic.

Bottom Line

While it's important to stay informed, the fears of a new housing crisis are largely unfounded, especially in luxury markets like Beverly Hills and Los Angeles. Homeowners and buyers in these areas can feel confident about the stability of their investments, given the underlying strength of the local real estate market.

Call Christophe Choo at (310) 777-6342 to tour your future home "HERE" or click "HERE" to estimate your home value